JONES LAW GROUPYour Lawyers for Life! Personal Injury Law Firm in St. Petersburg

If you’ve suffered a severe injury in a car accident caused by another driver, you’re probably wondering how your health insurance will affect your ability to pay your medical bills. Health insurance is basically a last resort when it comes to paying medical expenses after a wreck. Your insurer might send your bills to your […]

Call our personal injury law office directly at (727) 512-9847

At Jones Law Group in St. Petersburg, FL, we would like to hear from you. Contact us for a free personal injury case consultation.

Call our personal injury law office at (727) 512-9847

Get educated on the Florida's personal injury laws and more.

If you’ve suffered a severe injury in a car accident caused by another driver, you’re probably wondering how your health insurance will affect your ability to pay your medical bills. Health insurance is basically a last resort when it comes to paying medical expenses after a wreck. Your insurer might send your bills to your car insurance company first and then pay whatever your personal injury protection (PIP) and other coverage don’t handle. Here’s everything you need to know about using health insurance for car accident damages.

This can be highly complex, but an attorney with the Jones Law Group can help clear things up. We can also work to help you obtain the compensation you deserve from those to blame for your suffering. Call (727) 571-1333 or contact us online for a free consultation.

A health insurance lien is a legal claim that an insurance company can make on a portion of the settlement or judgment obtained by an individual in a personal injury case. When a person is injured and receives medical treatment, their health insurance company will typically pay for a portion of their medical expenses. You might be able to file a lawsuit to seek compensation for your damages, including medical expenses, if another driver’s negligence caused your injury.

When the case reaches a settlement, or you win an award from a jury, the health insurance company may be entitled to recover some or all of the money they paid for your medical treatment. This is known as a health insurance lien. The lien allows the insurance company to recover the amount they paid for medical treatment from the settlement or judgment you may obtain.

A health insurance lien can significantly impact the amount of compensation you’ll receive. In some cases, the lien may be negotiable, and an experienced personal injury attorney may be able to reduce the amount.

Many people wonder whether they must use their health insurance to cover the costs of medical treatment after a car wreck. The answer can depend on several factors, including the terms of the health insurance policy and the specific circumstances of the accident.

In general, if you have health insurance, it’s a good idea to use it to cover the costs of medical treatment. This is because health insurance can help limit your out-of-pocket expenses and ensure you have access to the medical care you need to recover from your injuries.

But you don’t have to use it. If you have other methods of paying for treatment, you could use those. For example, you could arrange with your doctor to pay them out of your compensation. If you have Medpay as part of your car insurance, that could possibly cover your medical expenses.

A seasoned car accident attorney can help you understand your legal rights and options. Your attorney can work with your health insurance company to help ensure that you receive the total compensation you’re entitled to for your injuries and related expenses.

Health insurance can have a significant impact on a car accident claim. If you’re injured in a car accident, your health insurance may cover the cost of your medical treatment. This can limit your out-of-pocket expenses and ensure you have access to the medical care you need.

As stated earlier, your health insurance company may have a right to recover some or all of the costs of your medical treatment from any settlement or judgment you receive by taking legal action against the at-fault driver. This is the health insurance lien.

In some cases, your health insurance company may be entitled to a portion of the settlement or judgment. This is true even if they didn’t cover the total cost of your medical treatment. Again, health insurance is a complicated issue. It’s essential you work with a knowledgeable car accident lawyer who can help you navigate the complications.

Without health insurance, you may not have access to the medical care you need to recover from your injuries. You may be responsible for paying for your medical treatment out of pocket. Some people will hesitate to go to the doctor because they’re not covered and hurt their case. If you didn’t get medical treatment, the insurance company may claim that you’re not seriously injured.

However, a lack of health insurance doesn’t necessarily mean you can’t pursue a car accident case. In some cases, your attorney may be able to help you find alternative sources of medical care and financing.

As you can see, this subject is complex. But a Jones Law Group attorney can explain the relationship between health insurance and a car accident case. Our firm has a team of experts who will gladly answer all of your questions. Just as importantly, we’ll provide the aggressive representation it will take to ensure you get every dollar you have coming.

We realize you have a lot of options when it comes to legal representation. We’ll never make any promises regarding how much money you’ll get. However, we promise no one will work harder on your behalf. Our firm has a long track record of success in similar cases. We’re ready to put our knowledge and passion to work for you. We’ll investigate to determine why the accident happened and also to find who’s responsible.

Please don’t hesitate to use our online contact form for a free evaluation of your case or call (727) 571-1333. We look forward to hearing from you.

You may be entitled to compensation if a private homeowner’s negligence caused your slip-and-fall accident. Summary When visiting another person’s home, you expect the homeowner to upkeep their house so that no walking hazards can lead to a slip-and-fall accident. However, that is not always the case. Unfortunately, a private property homeowner’s negligence can lead […]

Motorcycle accidents can be devastating, leaving victims with lifelong injuries that can affect their income, mental health, and general stability. Devastating injuries can cause a loss of income, major lifestyle changes, and much more. These injuries often occur at the fault of another driver who’s acting with negligence. If you or someone you love has […]

It won’t take long before the at-fault driver’s insurance company sends an adjuster to get you to agree to a settlement. This skilled professional might act like they’re your friend and want to help, but they’ll be anything but friendly. Insurance adjusters will try to trick you into making a mistake that could damage your […]

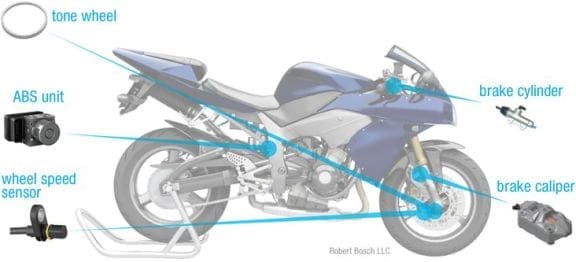

Everyone reads about the technological safety advances for automobiles. Car accidents become less likely every day. Four states, one of which is Florida, have passed laws allowing driverless cars on the roads. Cars are increasingly becoming equipped with forward collision warning, blind spot detection, lane departure warning, lane departure prevention, auto braking, adaptive headlights, and […]

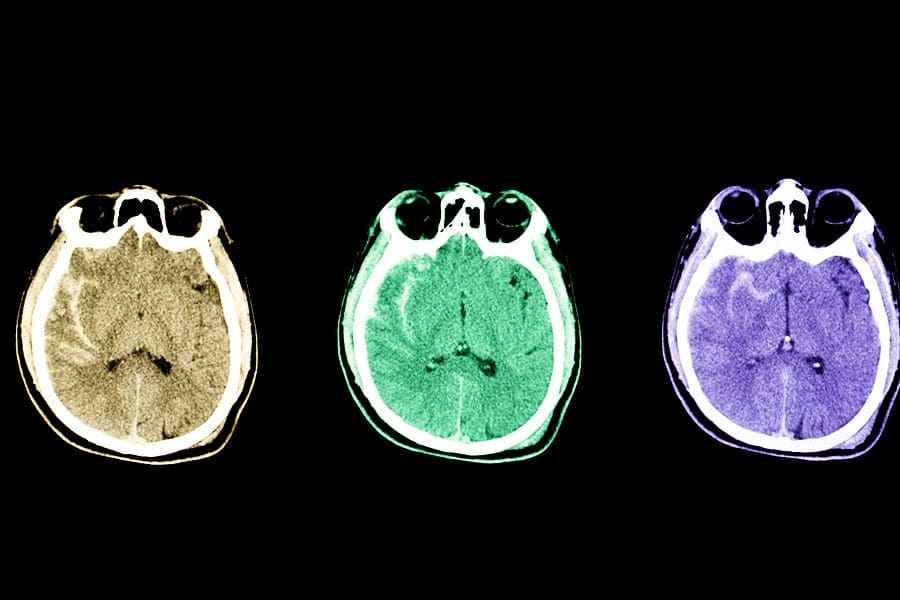

There aren’t many injuries worse than a traumatic brain injury (TBI). A TBI is catastrophic because it can rob a victim of their ability to perform the most basic of tasks, much less enjoy any quality of life. Simply put, the consequences of traumatic brain injuries can be devastating and hard to handle alone. The […]

There is a lot of misinformation regarding Florida’s insurance requirements for motorcycles. Is it required? Do you get PIP benefits? How much should insurance should you carry? Are the aftermarket modifications to your motorcycle covered? Should I get uninsured/underinsured motorist coverage? I will address each of these issues in this article. Do You Need Insurance […]

Speak with us before time runs out! In Florida, you have a limited window to file a personal injury case, so speak to an Attorney today.

Call our personal injury law office directly at (727) 512-9847

Jones Law Group is a dedicated personal injury lawyer in St. Petersburg, FL, serving the Tampa Bay area since 2006. Our experienced attorneys specialize in car accidents, slip and fall cases, employment law disputes, construction law issues, and overtime wage claims, fighting for maximum compensation on a contingency fee basis. Contact us for a free consultation to discuss your case.

Call our personal injury law office at (727) 512-9847

© Copyright 2006–2025 Jones Law Group Attorneys at Law. All rights reserved. Privacy Policy Terms of Use

Attorney Advertising.

The information on this website is for general information purposes only. Nothing on this site should be taken as legal advice for any individual case or situation. This information is not intended to create, and receipt or viewing does not constitute, an attorney-client relationship. Past results do not guarantee similar outcomes.

Are you injured or wronged and interested in a consultation? Fill out the form for a free consultation with us.